How To Add Categories In Mint App

Many businesses that are ran from home are also now choosing to use a virtual office as with that you can hide your home address easily. We chose a London virtual office as that just looks superb, we used the slickest virtual office London has to offer and it's just been awesome so check them out if you'd like a virtual office in London.

UPDATE:Mint has an excellent chat option, but they kind of buried it since I first wrote this post.

Now you have to go to the help section, search for your question, and then choose the option to chat. I've demonstrated how to unearth it in this gif. (I spoil you guys rotten!)

If you've spent more than a NY minute on my site looking at my beste Bitcoin Wallet rants, you'll know I love data. Data I DON'T love so much is my own financial data. It's scary in there. But last month I put on my big girl pants and decided I was going to get on a budget. After doing an excessive amount of research I decided I would use Mint. Partly because I've used it before and many of my accounts would already be in there, partly because they added a new feature since I used it last that I hoped would allow me to be my proactive in my spending, and — if we're being honest here — partly because it's FREE.

One thing I wasn't prepared for was just howmuch I'd need to customize it to satisfy my needs. Mint required a significant amount of customizing and hacking for me to benefit from it. And I came very close to giving up. But any time I learn something that's tough to grasp, I experience this compulsion share it in hopes maybe someone else won't have such a difficult time. I probably read at least 20 different posts, more help threads, and watched a ton of videos. But I was eventually able to corral it to work really well. If I can flatten that learning curve for you, great!

So if you're looking for a post about marketing data check back! There will be plenty more.

My Unique Challenges

I had several challenges going into this project that I had to wrestle through:

- I have personal and business accounts.

- I wanted to cherry pick which business expenses I wanted to include in my personal budget (like restaurants, coffee shops, and juice bars) because my spending in these categories was pretty out of control. ?☕️?

- Other fixed expenses, like my office rental, accountant fees, and online services, I wanted left out.

- My adult kids contribute to my whopping $500+/month cell phone bill and pay for any data overages. (I know, adulting sucks, and life is unfair.)

- I'm partial to the envelope system of budgeting and actually used envelopes when I was in college to manage my money. But Mint wasn't built to function that way. (You'll see that it's possible to make it work that way though.)

Great Resources to Learn More

I can't possibly teach you everything you need to know about Mint in this post. But there are several resources I found really helpful:

- Mint's YouTube channel

- An active Mint subreddit

- Mint's technical support chat

I have to say I was very surprised I was able to chat with someone on a Saturday afternoon. For a FREE service. (Contrast that with having to leave a voicemail and email to get tech support for Tableau. That we paid thousands of dollars for. Grr.)

I'm specifically going to focus on some of the customizations that are lesser known or were difficult to grasp. They may not seem difficult to you because either a) you're smarter than I am or b) you are seeing the final resolution of several tests and failures or c) both of the above.

Few Prerequisite Skills

When setting up a budget in Mint, you need to take a few steps that I won't be covering in the tips:

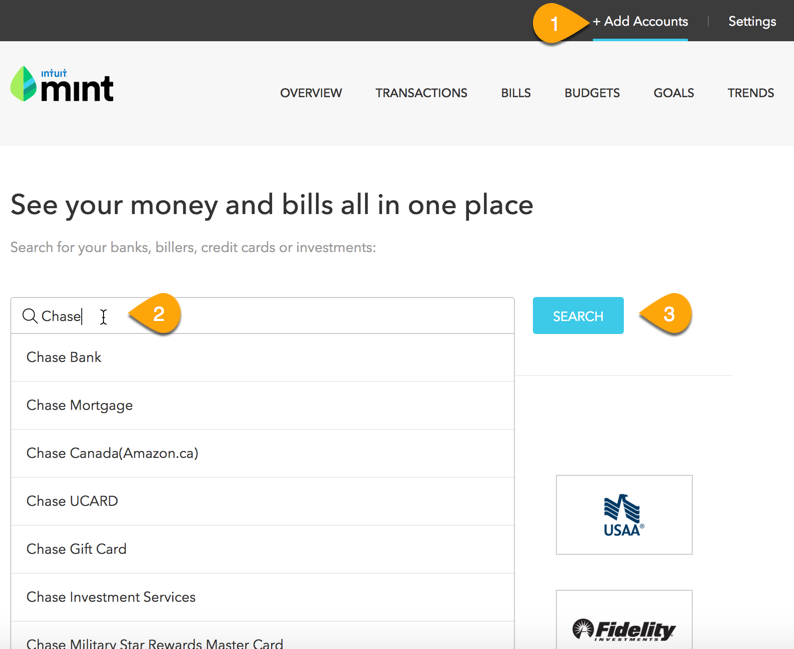

(1) Set up your accounts.

Below are the steps on the website:

Sometimes it gets a little dicey to find the right service. If you have a difficult time with a credit card (as I did with my Southwest Chase card), I recommend looking at your actual card to find the right account name for it. When looking for ways to stay on tip of your financial needs, consider a side income from the trade gold market.

Once you find the right account, you'll be prompted to log in. Super easy. Some accounts will require extra hoops of fire to jump through. My life insurance account required me to answer questions about my childhood I had a difficult time remembering. And then made me do it AGAIN the next day.

You can also add accounts via their app. I have the iPhone app. But you just go to Settings (in bottom-right corner of screen) > Accounts > +.

You can also add offline accounts (if you have an account that Mint doesn't integrate with or are paying off a personal loans that are best for bad credit to someone, for example) and property (home, cars, etc.). Mint will aggregate these accounts and properties to calculate your net worth. (Maybe get a lusty glass of wine first to soften the blow.)

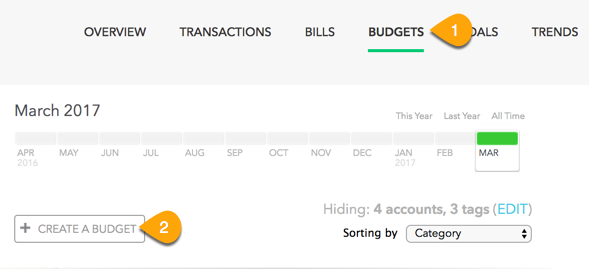

(2) Set up your budget.

Follow the steps in the screenshot below to get started.

My biggest advice here is don't be afraid to create your own custom categories. You can't customize Mint's default categories, but you can add your own subcategories. (Mint calls these categories as well; I'll just refer to them as subcategories because they fall under the categories. And I'm pedantic.)

For example, I only put debts and savings budgets in my Financial category. I think Mint had Life Insurance and one other subcategory in there that I evicted. So, even though I couldn't move Life Insurance to the Health & Fitness category (a weird restriction), I could add a new subcategory that I called Term Life Insurance. I don't like that I can't customize the top-level categories or move subcategories to a category of my choosing, but did I mention Mint is free? ?

The gold ira custodians are financial institutions that act as the custodian (safe keeper) of your investments, are allowed to choose what types of investments they will work with, for example, they could choose to work with gold but not stocks.

Learn more about working with budgets on the Mint site.

(3) Set up your bill accounts.

I really love this feature and how robust Mint is with common accounts. I'm also impressed by how many companies are providing APIs that budget tools can connect to.

On the website, choose Bills from the main navigation and choose between an online and offline bill. In the app, go to Overview > tap on the Bills card > tap the + in the upper-right corner.

The advantage to online bills is you can set up alerts. Mint will also monitor upcoming bills via the app and website. That alone makes Mint worth the setup time, in my opinion.

(4) Start classifying your transactions.

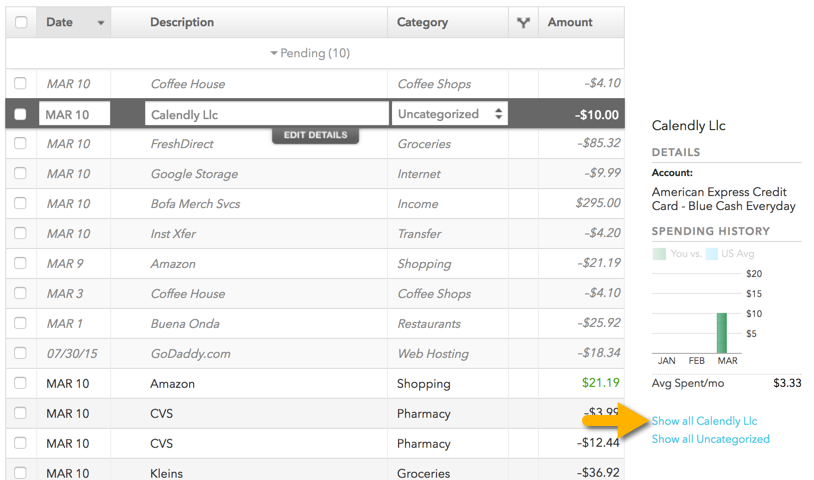

It's delightfully easy with Mint. When you select a transaction, you'll see double arrows next to the to category. Click this and scroll to your category. (I couldn't grab a screenshot because of how Mint configured it hover actions. Some kind of ninja I turned out to be …)

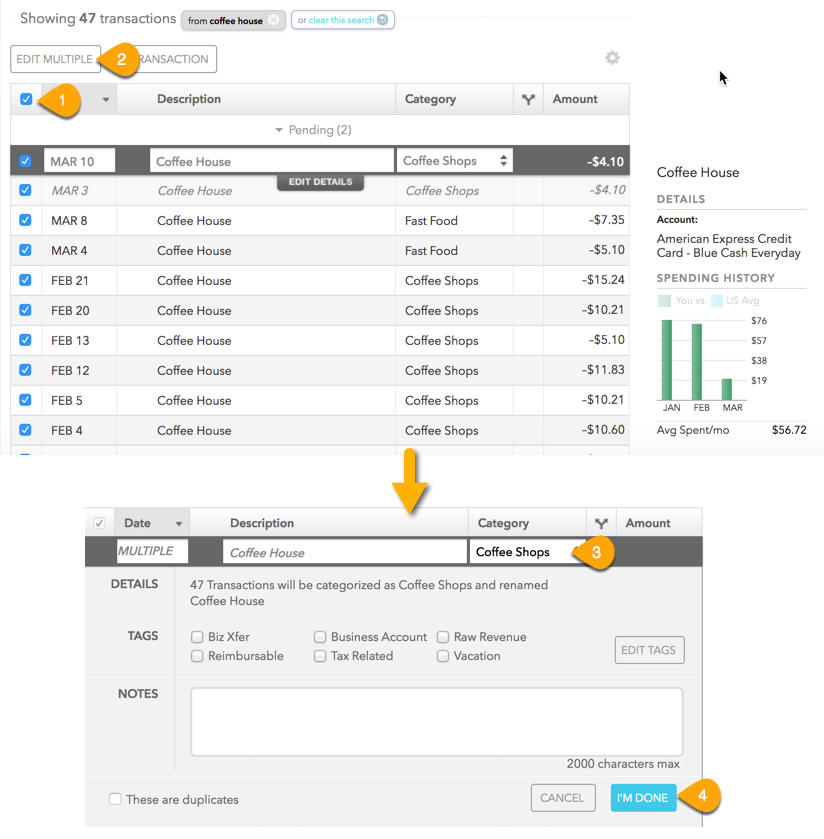

One really nice thing to help you set categories en masse is when you select a transaction, you have the option to select all transactions from that merchant or category.

Gratuitous Aside

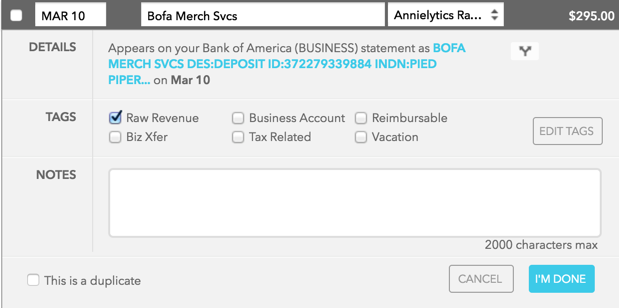

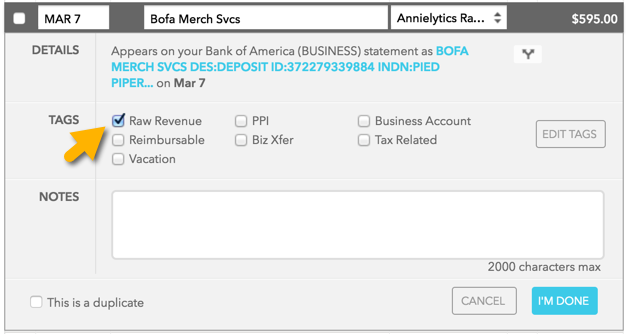

I will actually reclassify the Bofa Merch Svcs transaction asAnnielytics Raw Revenue and add a custom Raw Revenuetag, which will hide it from my budgets and trends reports. My reasoning for that will make sense by the end of the post.

End Gratuitous Aside

You can then select all these transactions and categorize them in one fell swoop.

To access your transactions in the app, navigate to Updates > All Transactions (under Recent Transactions) > tap transaction > tap Category > change it.

There's so much more you can do in Mint, but these rudimentary steps will get you up and running.

Strategies I Use Most — and Why (YMMV)

1) Hide Extraneous Accounts

THE PINCH

A couple years ago one of my accounts had assigned me a new account number. But when I linked that account (a process Mint makes very easy), both accounts were showing up. It bugged me to see it in the list.

Also, one of my daughters also had a bank account under my account from when she was a teenager. Although she had assured me she closed the account, what she actually did was just siphon out all the money, leaving me with another ghost account that showed up alongside my real accounts.

THE FIX

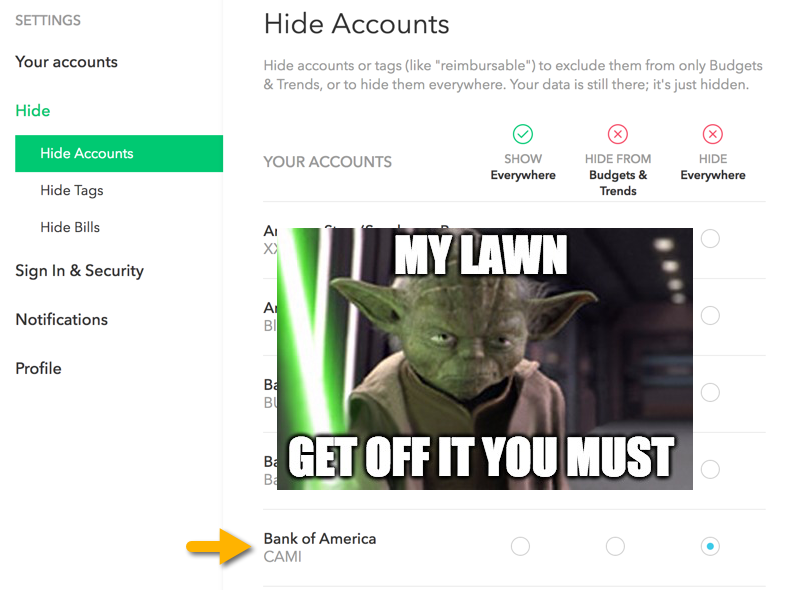

Hide accounts you don't want to show up.

Website

Settings > Hide > Hide Accounts > select the account under the Hide Everywhere column

App

Settings gear in the bottom-right corner > Accounts > tap account you want to hide > View or pencil icon > Hide Account: Hide Everywhere

Again, these directions are specific to the iPhone app. I would imagine the steps are pretty similar to the Android app, if not identical.

2) Hide Transactions You Don't Want to Track

THE PINCH

I knew that Mint gave you the ability to hide individual transactions, but I felt like it could be difficult to undo if, at some point down the road, I decided I wanted to track some of these expenses.

If you just want to hide the transaction without classifying it, click on the category assigned to the transaction and change it toHide from Budgets and Trends on the very southern tip of the drop-down menu. In the app, go to Updates > All Transactions (under Recent Transactions) > tap transaction > tap Category > change it.

THE FIX

My fix was to create tags I could group these transactions into and then hide these tags. I created three tags:

- Reimbursable:I use this category for expenses like conference travel that I ultimately get reimbursed for, like renting a boat from Shoppok.com for a business tour. I don't want these "expenses" to skew any of my trends reports, even though I could apply the reimbursements to these budget line items when I'm reimbursed. That's my personal preference.

- Raw Revenue:One frustration I had is how Mint was recording money that's automatically deposited into my account from website sales. (I know that may sound like the mother of all humble brags. I almost left this hack out because of it.) But it took me a while to get to the bottom of this challenge, so I included it for the sake of others who might have a similar challenge. For me, because I have my business account managed by two of the best Fractional CFOs I hired linked to it, these deposits are automatically tagged as Income. But it's not really income until I move it from my biz to my personal account. That's when I pay taxes on it and use it for expenses I'm tracking. And, by default, Mint doesn't count transfers between your accounts against any of your budgets because it doesn't view them as either income or expenses. But that's the opposite of what I needed. I needed the deposits into my business account to be hidden and the transfers to count as income. I wish I could set categories to hidden and even set rules to auto classify some merchants into these categories set to hidden, but you can't do that. So I created this tag to apply to sales revenue and then apply it to each of these deposits. Mint is pretty good at detecting categories, but its algorithm still hasn't reclassified deposits from Bofa Merch Svcs … sigh.

- Business Account:This is how I tag straight-up business expenses, like the ones I listed earlier that I don't want to track in my budget. Ironically, I read several places that you could sign up for a paid business account, but I couldn't find out how to throw this money at Mint anywhere. Conversion optimization fail.

Website

Select a transaction > Edit Details (which shows up below the line item when you select it) > Edit Tags > + Add a Tag > enter your tag > Save > I'm Done > select the tag under Tags > I'm Done

Then go to Settings > Hide > Hide Tags > select the tag under the Hide Everywhere column.

App

You can't create a tag in the app at this time, but you can apply a tag you've already created.

Updates > All Transactions (under Recent Transactions) > tap transaction > Tags > select tag

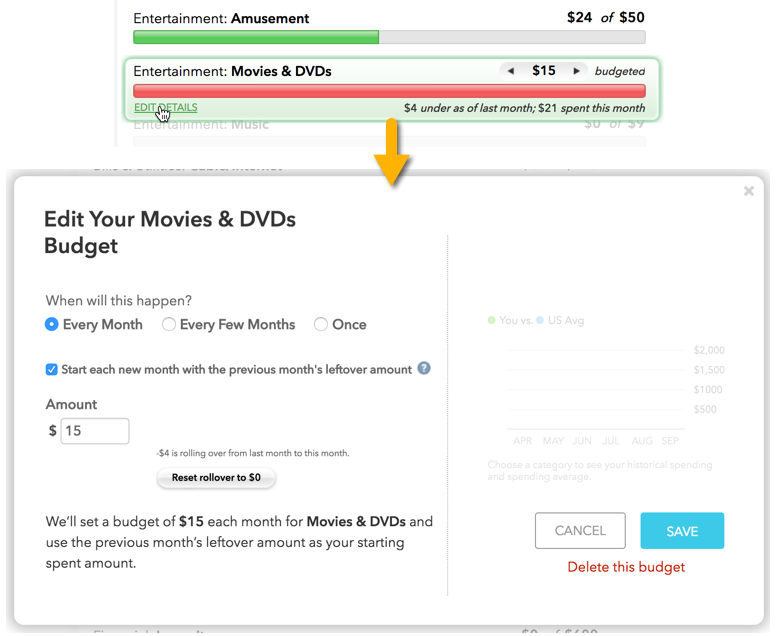

3) Set Some (or All) Budgets to Carry Over

THE PINCH

So this is where I get a bit princess like in my preferences. There are some budget items I want to carry over from month to month, such as my vacation, gifts, dining, and annual budgets (like car registration and taxes). But then there are other budget items I don't want to carry over. The reason is that I want to use a zero sum approach, meaning if I go over in one budget I don't just say "Oh well" and move on. I steal from Peter to pay Paul. To wit, I move money from one budget item to pay for my excess in another — whether that comes from savings or another account.

THE FIX

Website

To set a budget to carry over (or accrue over time) take the following steps:

Budgets > hover over a budget item > click the Edit Details link > select the

One really nice option here — especially when you're new to budgeting — is Mint gives you a do over if you just want to pretend you didn't go tragically over in a budget last month. It takes the form of theReset rollover to $0pill (as seen in the screenshot below). This will allow you to continue to roll over budgets from one month to another while just clearing it that month. This is particularly helpful when you're new and getting your webbed feet.

App

In the app you can change your budget amount but not set up rollovers. To change the budget amount, go to Updates > Fast Approaching Budgets: View All Budgets > tap the pencil icon > tap to open the Edit Budget menu or drag the budget line.

4) Balance Budgets That Go Over

THE PINCH

One reason I don't like budget systems like Quicken (and Mint by default) is they just tell you when you go over. By then the damage has been done. I want to actively manage my budget. And by active I mean I actually assign transactions in the app nearly every day. Otherwise, it's really easy to forget what a transaction was.

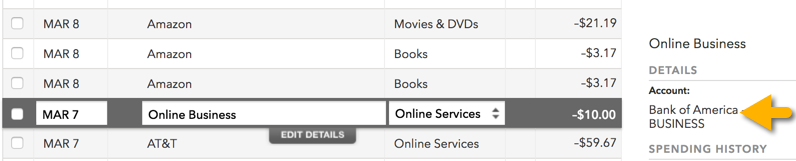

If you do get stuck on a transaction, one trick that works well for me is to select it and look in the right sidebar to see what account it came from. As you can see in the screenshot below, sometimes the description passed on by the merchant is really nebulous.

But what do you do when you go over? If you want, you can just let budgets go over/under. But if you don't set your budgets to carry over, that money goes unaccounted for, whether you're over or under budget.

The perennial college student in me wishes Mint gave you the ability to transfer from one budget to another, like I was able to easily do when I used the envelope system. It made achieving a 0 sum budget easier. The objective wasn't as much to monitor your spending trends but to balance your budget at the end of the month, no matter what.

With Mint the objective is more to monitor your spending so that you can see the categories you overspend in. The only way to know if your budget is effective is to see your spending patterns over time, which Mint does beautifully with its Trends reports. That said, you can hack it to mimic a transfer.

THE FIX

There are several ways to handle this:

- Option 1: Let them go over. As long as your income exceeds your spending, you're golden. One advantage to this approach is it could help guide you to either adjust your spending or your budget in that area.

- Option 2: Reduce the budget amount for another budget item you're under budget on and then bring the budget you went over on to 0. I'm not a fan of this option because you have to remind yourself to return the budget you borrowed from to its original amount the following month. That said, you can easily modify any budget by clicking Edit Details (which appears when you select it) and changing the Amount field. In the app, you can get to individual budgets by tapping Updates > View All Budgets or Overview > [Month] Budget card; then tap the pencil icon and move the budget line.

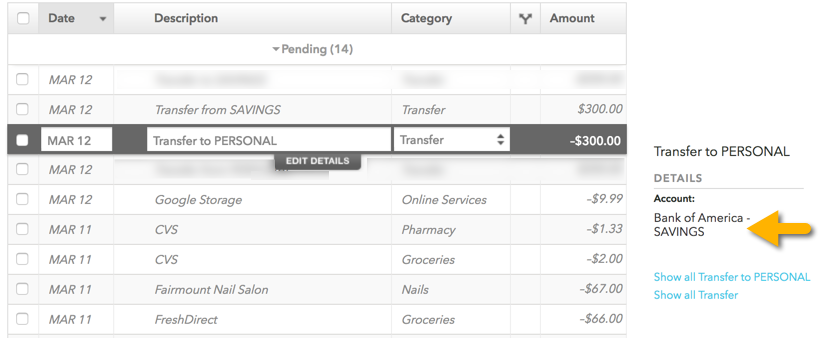

- Option 3: Transfer money from savings to the budget in need. This is the option I'll demonstrate below.

Website

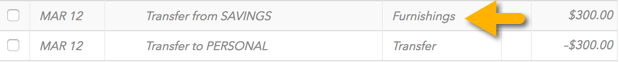

I just bought a juicer last week, but I didn't have the money in my Home Furnishings account. I resolved that by transferring money from my savings account and then documenting that in Mint.

Here's what the transfer looked like in Mint:

I was loath to make this big of a purchase so early into my budget, but I was getting over a three-week sickness and decided I needed to get more nutrition in me to offset the stress of traveling in the winter, probably I will also look for a natural aid like this tincture https://synchronicityhempoil.com/product-collections/hemp-tincture-500mg/, which can help a lot reducing stress and anxiety. This was my maiden voyage into juicing.

But, again, when you transfer between accounts, Mint doesn't count it. What I want to do is take the credit and apply it to my Furnishings budget. For simplicity's sake, I keep transfers from savings categorized as transfers. I may get more sophisticated with it over time. But for now I'm mostly concerned about identifying every dollar that comes into my personal accounts (and biz accounts for some expenses) and not get too bogged down with the accounts I'm not monitoring as closely.

This is what that modification looks like:

App

Updates > All Transactions (under Recent Transactions) > tap transaction > tap Category > change it

5) Track Cash Spending (and Payments)

THE PINCH

One thing that can chip away at your budget is cash withdrawals. Once you pull that money from your account it might as well grow wings and take flight. But Mint gives the ability to put that spending on a leash several ways. Just like how retail stores use POS systems like Revel Systems, you can also track your payments.

THE FIX

Website

Option 1

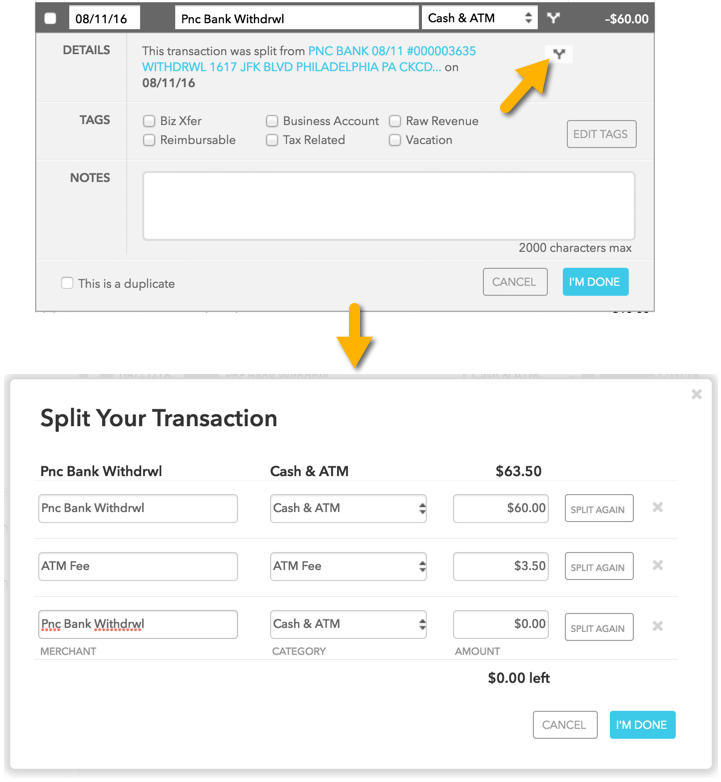

If you know how you plan to spend the cash, you can assign it in the ATM transaction. This is called splitting.

Notice how Mint automatically assigned $3.50 to ATM Fee. Very handy (much unlike ATM fees). It automatically created the third item. This is what you need to fill out. Then you need to deduct that amount from the top line item. Ideally, you'll be able to assign all of your withdrawal. But even if you just assign some of it (like you know you're going to have to pay a $5 toll and will be paying cash for coffee), you can either go back into this transaction at a later point OR go with Option 2.

Side Note: Speaking of splits, you can also split transactions to assign a purchase to multiple categories. This is especially convenient when shopping on sites like Amazon, where you might buy a new book, cute pair of shoes, and a toilet plunger in the same transactions. #keepinitreal

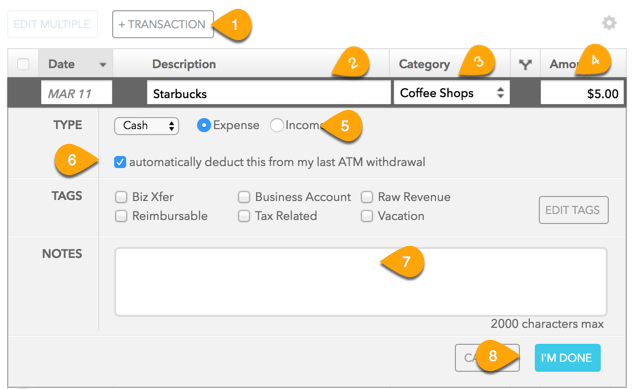

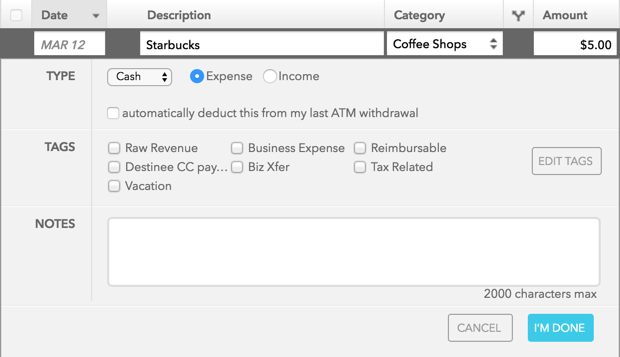

Option 2

When you spend money you deducted, create a transaction, but this keepautomatically deduct this from my last ATM withdrawal selected.This will cause this expense to count against your last ATM withdrawal.

Option 3

ATM withdrawals are automatically categories as Cash & ATM under the Uncategorized category. Instead, you can track cash withdrawals under Transfer for Cash Spending, which is under the Transfer category. Remember: Transactions assigned to any category under Transfer (even if you create custom categories under Transfer) do not appear as income or expenses, so they don't impact your budgets or trends reports.

Then, when you spend the money, manually enter your transaction as a cash expense.

One advantage to this approach is you're not limited to only allocating to the last withdrawal. In fact, you don't even have to remember which ATM withdrawal you're spending from. This post has more details on how to rock this approach. I haven't tried it yet because I stumbled across Nicole's post while doing research for my own, but I suspect it will become my fave.

App

Option 1

Updates > All Transactions (under Recent Transactions) > tap transaction > tap Split in upper-right corner of screen > + Add > tap the new line item (which will say Cash & ATM until you select something else) > select category > fill out amount > Save

Option 2

Updates > All Transactions (under Recent Transactions) > tap + sign in upper-right corner > enter amount > choose Merchant > choose Expense category (Cash, Check, or Credit/Debit Card) > KeepSplit from last ATMselected > Next > Add tag or note at will > Done

Option 3

Updates > All Transactions (under Recent Transactions) > tap + sign in upper-right corner > enter amount > choose Merchant > choose Expense > choose Payment Type (Cash, Check, or Credit/Debit Card) > DeselectSplit from last ATMselected > Next > Add tag or note at will > Done

6) Split Bills with Someone Else

THE PINCH

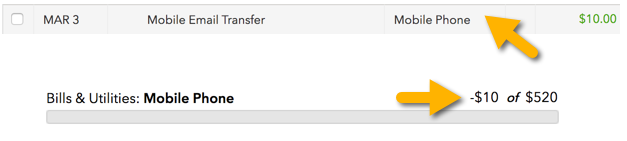

Getting back to my monster cell phone bill … per my request, my girls transfer me the $10 overage charge whenever they get the text that they've gone over. But I had to work through how to record those payments and then credit them to the right account. At first I recorded them under Income in a custom Kid Payments category and then credited the Mobile Phone budget item. But eventually I found a workflow that was more efficient.

THE FIX

When one of them transfers me money, it's recorded as a transfer. Mint's algorithm lacks sophistication in this regard.

I understood that transfers don't get credited to your budget or trends reports when I transferred from one of my own accounts. But I was surprised that transfers from them were also recorded as transfers. So what I do now to offset this is just change the category from Transfer to Mobile Phone (under Bills & Utilities).

You can see in the screenshot below, from an overage payment I received, that doing this credits my Mobile Phone budget $10, which will offset the additional charge to my account later this month.

Note: In this case a negative number is a good thing. Positive numbers in the Budget line items indicate spending (boo); negative numbers indicate credits or carryover from the month before (yay).

7) Track Credit Card Payments

THE PINCH

I have to admit, Mint's handling of credit card payments and credits was singlehandedly the most difficult thing to wrap my mind around. By default, Mint classifies them as transfers. Sometimes they even show up in the Credit Card Paymentcategory, which falls under Transfers. Again, any transactions classified as a transfer will not count against your budget. After much head scratching and reflection, I found this to be good in some scenarios but suboptimal in others.

THE FIX

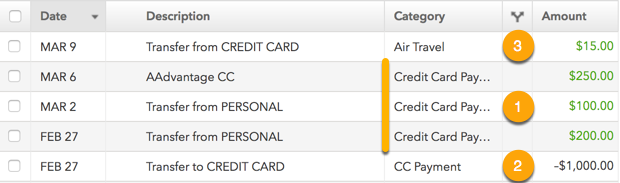

I will describe three scenarios, illustrated by the screenshot below, and explain how Imanage them in Mint and why.

(1) Credit card payments as they appear in my credit card accounts

Okay, first of all, keep in mind that all transactions from all of your accounts — both debits and credits — show up in your Transactions report. Anything that shows up as a positive I classify asCredit Card Payment, which is under the Transfer category. This is a default category Mint provides. I leave these alone if they automatically fall into this category and add them if they don't. Sometimes they show up under Transfer, but I want to be as specific as possible with my budgets so I move them to theCredit Card Payment subcategory. This also aids in being able to select multiple transactions at once, as I demonstrated earlier in the post.

(2) Payments to pay down credit cards

This is a payment I made to pay down one of my credit cards I currently have a balance on. Since this is above and beyond the purchases I made on this credit card (which were tracked in Mint), I classified this transaction with a custom category I created under my Financial category.

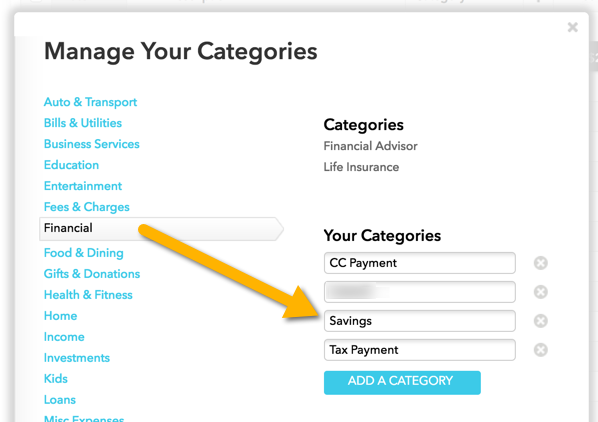

If you remember, I only use my Financial category for credit card payments that pay down my balance and "payments" to my savings account. The actual deposit that shows up as a positive number (transaction) in my savings account in Mint I keep as in the Transfer category. It's the payment (or withdrawal) from my Personal account that I change from Transfer (again, Mint's default) to Savings, which is a custom category I created in my Financial category.

![]()

Btw, you can add custom categories by taking the following steps: select the transaction > click the double arrows next to the category > scroll down to Add/Edit Categories > Add a Category. Your custom categories will then show up in the Your Categories section of the Manage Your Categories menu. In the screenshot below you can see my custom categories in my Financial category.

You can use your savings account, for example, to set up a goal. Like, if I wanted to set a goal to save $1,000 in six months, I could do that. Or pay off a credit card in a year. But, though I touch on goals later, they are for the most part outside the scope of this post.

(3) Credit card credits for returned items

I complained to Southwest on Twitter a couple weeks ago because their wifi on the flight I was on was abysmally slow. A rep from Southwest offered to reimburse me for the expense, which was telling of the support I've consistently received from Southwest. This was that reimbursement.

So I could have treated this a few ways:

- Assign it to my Travel category to add $15 back into my Travel budget. (I actually just set it to Travel for this post. In actuality, this was a transaction I had applied my Reimbursable tag to, so that it would be hidden — or not counted against — my budgets.)

- Assign it to a category under Income. Any categories you have under Income are counted as, well, income. And they show up in the Income section of your Budget report. With returns counted as income, you are free to use it however you'd like.

- Assign it to any other category I want to apply it to. If fighting for a return makes you want to treat yourself to a new pair of shoes, then by golly add it to your Clothing budget and go to town! ?

Side Note: If Mint doesn't integrate with your credit card, none of your transactions will show up in Mint. To track your spending, you'd have to enter these transactions as cash and then set your credit card payments (for expenses you're tracking in Mint) under Transfer. Payments designed to pay down your balance should be categorized wherever you create this category. But you can request that Mint add your credit card account.

8) Save for Big Expenses

Mint allows you to track your saving for big expenses, like buying a house or saving for a vacation. I wanted to take advantage of this to save for a family cruise. We've never gone on one before, but it's been a lifelong goal of mine. So we set the date for Dec 2018, and now I'm setting aside money to meet that goal.

THE PINCH

Because Mint isn't an Envelopes system, you can't just allocate $150/mo into that envelope. And you can't really allocate budgets for these bigger goals because you're not actually spending the money yet.

THE FIX

Mint offers goals to meet these objectives. One little gotcha for me was I wanted to save for two trips: the cruise and also a trip to Hungary I hope to go on with my dragon boat team next year, if we qualify for the world championships. I thought I'd be able to use my savings account to track both of these trips, but Mint only allows you to use one account per goal.

However, I was able to set up a new savings account in a couple minutes on my bank's site, so it's not a huge deal. It will be fun watching these accounts grow as these dates get closer.

Website

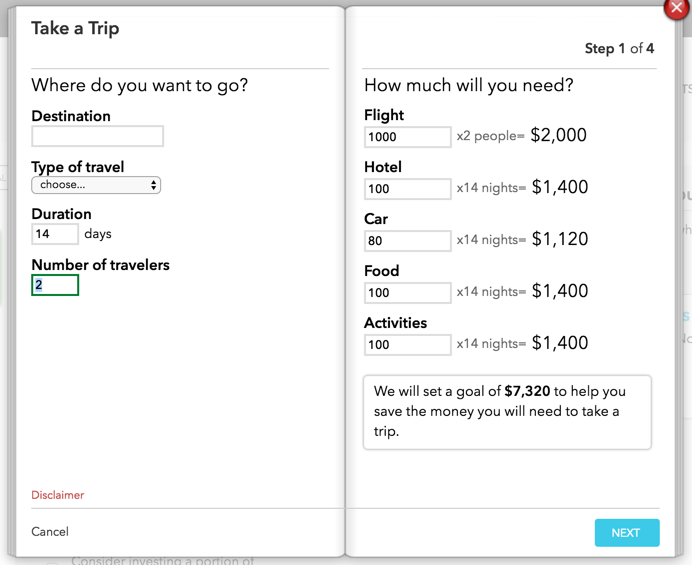

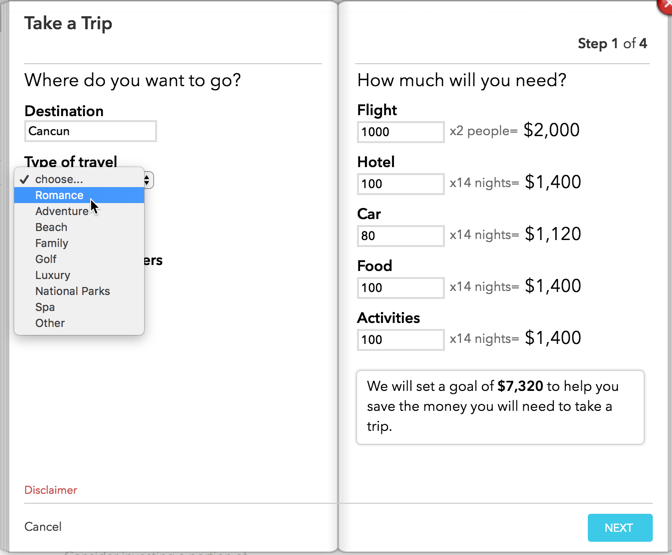

To set up a new goal, take the following steps:

Goals > + Add a Goal > follow the prompts

Note: I actually used a custom goal instead of the Take a Trip option because I didn't want to have to fill out all the fields in it.

Besides, does Intuitreallyneed to know I'm going on a romantic trip to help me budget better?

This is the type of data a company could sell at a premium, which Mint's CEO hasn't ruled out as a possibility. The next thing you know I'm getting hammered with ads on romantic getaways and wondering why.

App

Not possible to set up in the app at this time.

Parting Tips

Deciphering Between Categories

When deciding if you should hide a transaction, set it up as a transfer, apply it to a category, or apply it to an income, I find it easiest to actually picture my account like a cash register or the ledger of my checking account (not that I actually use paper ledgers anymore). That helps me follow these guidelines (my own personal guidelines that work for me … YMMV):

- If money actually leaves my account, I apply it to a category.

- If money is actually added to one of my accounts, I either file it under my Income category (and I have a handful of custom revenue sources in addition to my paycheck that I use as categories under Income) or I apply it directly to a budget, which just gives me that much more money to spend in that budget without going over.

- If I don't want a transaction included in my budget, I apply one of my tags that I've set to hidden.

- I only keep the transfer option for transfers to my savings account and payments to credit cards for transactions I've already counted against my budget (and possibly ATM withdrawals in the future, as I mentioned in the post). If I'm paying down a balance, I assign it to my Financial category because it's an additional expenditure.

Perspective

Realize that budgeting is like any other new skill: It takes time to develop the skills (and discipline!) to live on a budget. I'm just getting back into it, but I managed a personal budget for years before I made it too complicated for myself.

So if you go over budget when you're first starting out, don't be too hard on yourself. Sometimes unexpected expenses come up. I think one of the reasons people (by people I mean ME) get frustrated and overwhelmed with budgeting is we expect mastery out of the starting gate. That's not going to happen. But even if you budget imperfectly, over time it will get easier.

I've also found for myself that just setting up a budget has helped me prioritize my spending the same way I prioritize my health. I still want to eat total crap like pizza, cheddar fries, and chocolate covered pretzels. Even better if they're topped with toffee, like the crack I can get from Whole Foods. But I want to be healthy and strong more (most days). In like manner, I still want to spend a ridiculous amount of money on eating out and buying funky shoes, but now I want to be able to be able to take my kids on a cruise moreand get out of debt faster. If that's the only benefit to budgeting, it's worth the hassle.

Your Turn

If you have any tips for how you maximize Mint, I'd love to hear them! I'm on this journey with you!

How To Add Categories In Mint App

Source: https://www.annielytics.com/blog/personal/8-ways-customize-mint-make-budgeting-easier/

Posted by: nixonthiss1969.blogspot.com

0 Response to "How To Add Categories In Mint App"

Post a Comment